OPTrust Review: Grading the Quality of Customer Support

OPTrust claims to be a smart investment tool for clients to earn money. However, even just a short glance at their website proves otherwise. Read our OPTrust review to find out everything about the brokerage.

| Broker status: | Unregulated |

| Regulated by: | Unlicensed brokerage |

| Scammers Websites: | https://op-trust.com/ |

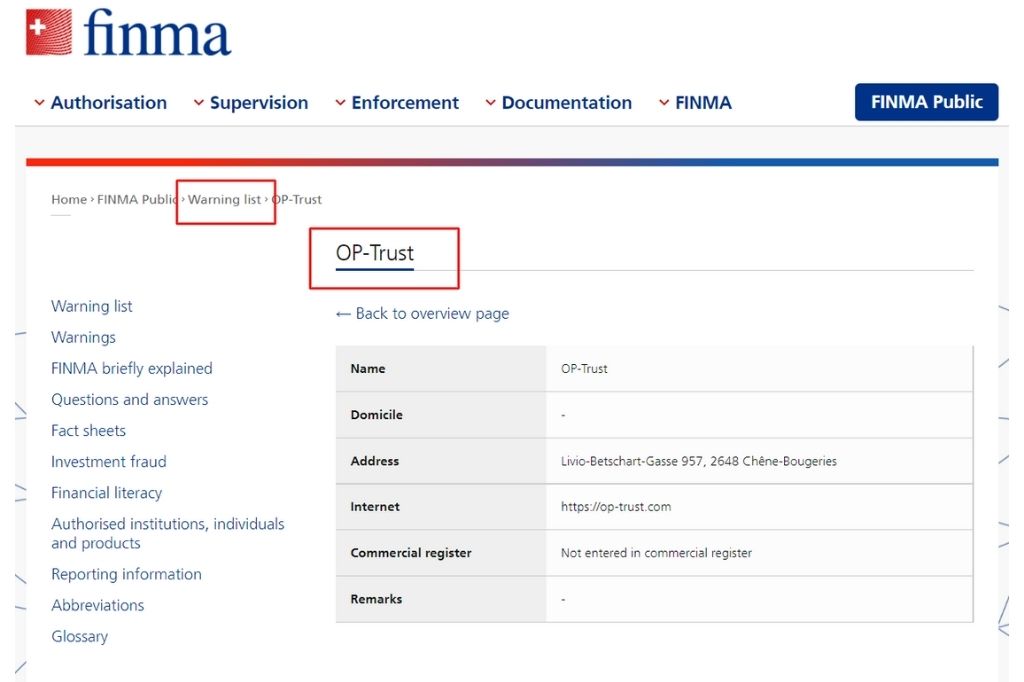

| Blacklisted as a Scam by: | FINMA (Swiss regulator) |

| Owned by: | N/A |

| Headquarters Country: | Switzerland |

| Foundation year: | N/A |

| Supported Platforms: | Web trader |

| Minimum Deposit: | $1,000 |

| Cryptocurrencies: | Available – BTC, ETH, DASH – total 6 |

| Types of Assets: | FX, commodities, indices, shares, cryptocurrencies |

| Maximum Leverage: | 1:500 |

| Free Demo Account: | No |

| Accepts US clients: | No |

About OPTrust Regulation and License

OP Trust hasn’t listed the owner behind the scenes or any of the relevant information. All we can see is some address in Switzerland, implying the company is based there. However, instead of listing the FINMA regulation number, we found two offshore licenses – from Belize and Mauritius. As there’s no official ownership, we cannot determine under which regulatory jurisdiction OPTrust broker belongs.

Beware of potential fraud!

In addition, we strongly advise you not to invest in Tredero, AskForBit and ImperialFunding fraudulent brokers.

OPTrust Warnings From Financial Regulators

Since the broker was declared Swiss-based, no wonder FINMA, the regulatory body of Switzerland, was the one to issue the warning against OP Trust. They said it’s an unregulated domicile, and anyone involved should be aware they are dealing with a fraudulent trading firm.

Fund Withdrawal Issues With OPTrust

Since the broker is not registered anywhere, has no official regulations, and cannot be found, it feels safe enough to defraud clients. Imagine giving your funds to a person whose name or address you don’t know. Finding them later would be a hassle, right? It’s the same with unregulated fraud brokers.

According to OP Trust reviews, clients, mostly Canadians, are complaining about being unable to withdraw their funds as the broker refuses to process requests. And once they insist too much, their accounts are being suspended.

False Claims About the Trading License

As mentioned, the broker claims to have two offshore regulations – IFSC Belize and FSC Mauritius. After checking both of these registers, we found nothing about the OPTrust broker. Since the company didn’t list the official owner, searching by their official name was impossible.

However, none of these regulators has anything about op-trust.com nor OPTrust trading name.

Traders About OPTrust Scam

Those who alerted about this scam firm were traders in the first place. All those who were ever involved with OPTrust have only one thing to say – stay away. None of them were able to get their money back and what’s worse is that they could not log in to their trading accounts anymore.

If something similar happens to you, let us know.

Also remember the names of the FX Quote 247, Smart Trade Group and CFreserve trading scams and avoid them at all costs! Moreover, always check the background of online trading companies before investing!

How Does Online Trading Scam Work?

Online trading scams are a part of participating in the financial market. Unfortunately, many firms nowadays open offshore headquarters and operate without regulations. It became simple to open a website and claim to be a financial service provider without anything to back it up. If, as is the case with OPTrust, you notice that the broker has regulations different than the headquarters and no official owner, start being suspicious.

For example, every legit firm will opt for a Tier1 license coming from the FCA, ASIC, or BaFin. These regulators oblige companies to form compensation funds worth around 700,000 EUR for reimbursing clients, which is your guarantee. With firms such as OPTrust, there are no guarantees, and your money is not safe.

Scammed by OPTrust? – Tell Us Your Story

If you were scammed by OPTrust or a similar bogus broker, don’t get desperate just yet. There is a solution – filing a dispute and requesting a chargeback.

But What Is A Chargeback?

This is a way for your bank to reverse a fraudulent transaction within 540 days since it occurred. For further details, please contact us via online chat. Book a free consultation with our experts who will evaluate your case and give you the best solution. Don’t let scammers run away with your hard-earned money; let’s make this first step!

What Is OPTrust?

OPTrust is an unregulated Forex and CFD online trading provider.

Is OPTrust A Scam Broker?

Totally! Broker has been blacklisted in Switzerland as an unregulated online fraud.

Is OPTrust Regulated?

This company is not regulated and provides financial services illegally.