Finpros Review: Can You Trust This Offshore Broker

Finpros Broker was founded in 2020 in Seychelles. The company offers FX and CFD trading services legitimately.

In this Finpros review, we are analyzing all trading tools, regulations, and terms of trading with this broker. All that is summarized will give you a bigger picture of the potential risks of investing with them.

Before we go any further, we suggest reading our brokerage reviews on SmartFX, CapitalXTend, and Mex Atlantic.

| Broker status: | Regulated Broker |

| Regulated by: | FSA Seychelles |

| Websites: | Finpros.com |

| Regulators’ Complaints: | N/A |

| Owned by: | Finquotes Financial Ltd |

| Headquarters Country: | Seychelles |

| Foundation year: | 2020 |

| Supported Platforms: | MT5 |

| Minimum Deposit: | $100 |

| Cryptocurrencies: | Yes – BTC, LTC, XRP |

| Types of Assets: | Forex, Commodities, Indices, Shares, Cryptocurrencies |

| Maximum Leverage: | 1:500 |

| Free Demo Account: | Yes |

| Accepts US clients: | Yes |

Does Finpros Have a Legit Forex License?

Seychelles is known as a hub of companies that often have shady activities. Yet, Finpros trading company is properly regulated by the FSA (Financial Services Authority). As the offshore regulator, you can’t expect them to provide security as Tier 1 regulators for example.� Therefore, we will look for the registers of the most trusted regulators. If this broker has any Tier 1 license it would be great.

However, upon the research of FCA, BaFin, and ASIC register we found nothing. This means that traders don’t have any compensation funds in case something goes wrong. For instance, traders with FCA-regulated brokers can get up to 85.000 GBP compensation. But with Finpros, there is none.

On the positive side, they claim to have negative balance protection. Yet, it’s not a mandatory requirement from the FSA.

Finpros has a loose offshore regulation and has already earned many negative reviews. Some of the reasons are an extremely high leverage, high swap fees, uncompetitive and non-transparent trading conditions, and withdrawal limitations.

What Platforms Does Finpros Offer? – Available Trade Software

Traders these days often look for fast execution and reliable apps. However, if the broker is not genuine, there is no use of good software.�

For instance, the Finpros broker provides access to MetaTrader 5. It allows traders to use more advanced tools. More than 35 indicators, Expert Advisors (EAs), multi-chart options, and many more. Besides, this broker has social trading as a very important aspect of trading these days.

Is The Platform Available On Mobile Devices? – Mobile Trading

As expected from the MetaTrader, it has apps for all iOS and Android devices. Traders can use all features on the run wherever they are. Not to mention even faster response and execution times.�

Therefore, it is very attractive to many. But this offshore regulation makes everything questionable.

Finpros’s Trading Assets and Instruments

�Like many other companies, Finpros has 5 major instrument classes. In general, nothing that Tier 1 licensed broker doesn’t provide. Except for higher security levels.�

Anyway, some of the instruments are:

- Forex – USD/JPY, AUD/CAD, GBP/NOK

- Commodities – natural gas, platinum, silver

- Indices – S&P 500, DAX 30, CAC 40

- Shares – Amazon, Deutsche Bank, Johnson & Johnson

- Cryptocurrencies – BTC, ETH, DASH

However, with leverage up to 1:500, trading these assets is very risky. Especially volatile ones that can wipe your account in a blink of an eye. Not to mention some Finpros reviews where traders reported extremely high swap fees.

Finpros Countries Of Service

Sometimes, brokers reveal on their websites what countries they don’t offer services to. This is the case with Finpros trading company.

The idea behind it is to avoid strict jurisdictions and regulations or to avoid poor countries. But in Finpros reviews, we can see where they offer services mostly in:

- United States

- Pakistan

- Vietnam

- Indonesia

- India

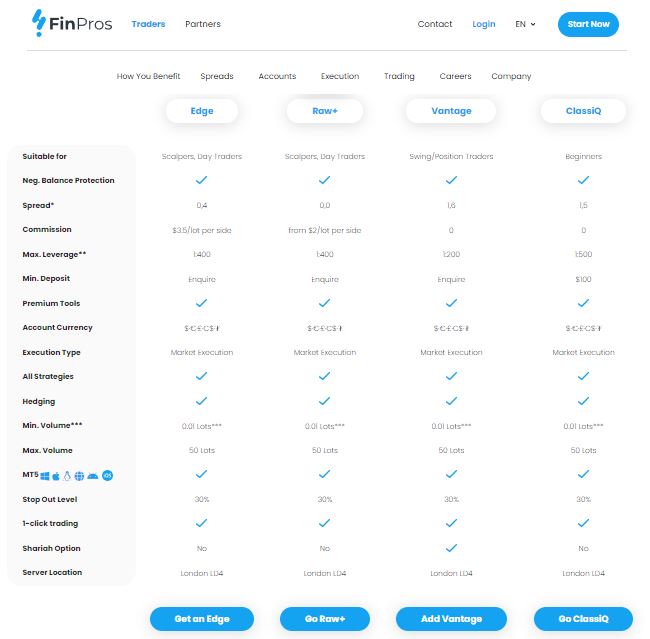

What Are The Different Finpros Account Types?��

Generally speaking, account types are designed to attract traders to make higher deposits. Of course, some trading conditions are beneficial in those cases. But only if the broker meets them.�

However, some Finpros reviews tell a different story. To sum up the offers, you can choose from:

- Edge

- Raw +

- Vantage

- ClassiQ

Can a Trader Use a Demo Account?

A demo is a great way to test the broker and its trading conditions. With MT5 that is very easily done.

On the positive side, Finpros broker claims to have demo accounts on every account type. On the negative side, some reviews claim that is not an option in reality.

The Importance of Negative Balance Protection For Traders

Another key point for traders is not going into debt. For instance, there were some cases where traders were losing all their life savings, even properties, due to debts.

However, Finpros claim to offer negative balance protection which keeps you away from it. Any losses that could lead you into a negative balance are reset to zero. Yet, this is unconfirmed so you have to register and test it out.

Terms of Service for Finpros

The main point where clients have potential issues with offshore brokers is withdrawals. This broker doesn’t have deposit and withdrawal fees. Important to mention is that the minimum deposit requirement is $100.�

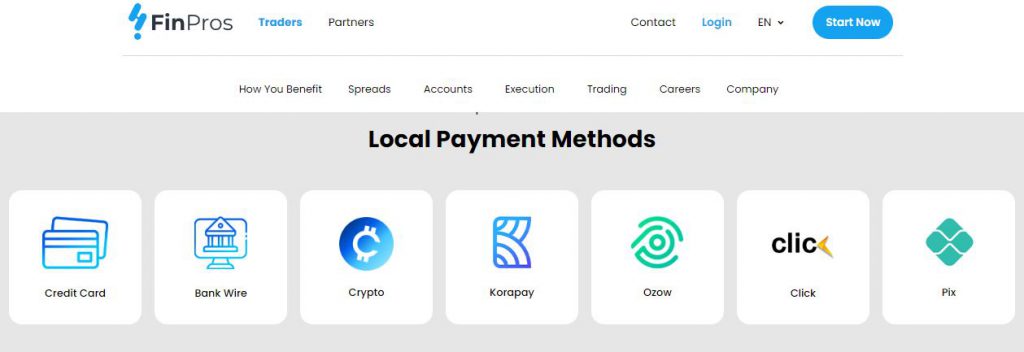

Here are some of the funding methods:

- Debit/credit cards

- Wire transfers

- Skrill

- Neteller

What raises our suspicion is that the broker can require from you additional documentation for every withdrawal request. Additionally, the broker claims the right to decline a withdrawal request if the amount exceeds 70% of the free margin. Important to realize is that Tier 1 regulated brokers would never limit you on withdrawals.

Leverage, Spreads, and Fees

In general, a leverage of 1:500 is not allowed according to any Tier 1 EU or worldwide regulation. This tells you how much protection you have with an offshore regulated company.

Spreads are not revealed on the brokers’ website, the same as swap fees. But from Finpros reviews, we could see that those are nothing close to competitive ones. Not to mention the minimum margin that must be traded for a certain asset. In fact, this is another point where a Tier 1 regulated broker would never force you.

What Should I Do If I Have Finpros Problem?

Primarily, you should share your experience with us. Our specialized team can advise you on any further steps. Before you take any action you can see for a solution with the FSA. But if you have withdrawal issues, the best option is to start a chargeback process.

Our fund recovery team can guide you step by step through the procedure. Book your free consultation today.

FAQ

What Is Finpros?

Finpros broker from Seychelles provides risky FX and CFD trading services since 2020.

Is Finpros a Regulated Broker?

Yes. But FSA regulation security can’t be compared to FCAs for example.

Is Finpros Available in the United States or the UK?

Finpros broker provides services to citizens from the US, but not the ones from the UK.

Does Finpros Offer a Demo Account?

Yes. The broker claims to offer a demo on any account type, but reviews say otherwise.