Swiss Markets Review: Is This Broker Reliable?

Swiss Markets broker is registered in 2016 in Mauritius. As a Forex and CFD broker, they are owned by BDS Markets Ltd. Mauritius is known as a hub for companies that are hiding something. That’s why we need to do an in-depth analysis. Luckily, Mauritius has its regulatory body FSA.

But not all regulators are trusted ones. All those facts, pros, and cons we will analyze in this Swiss Markets review. Keep reading.

In addition, we recommend reading our reviews about brokers FXLift, City Index, and SuperForex.

| Broker status: | Regulated Broker |

| Regulated by: | FSC, CySEC |

| Websites: | Swissmarkets.com |

| Regulators’ Complaints: | N/A |

| Owned by: | BDSwiss Group |

| Headquarters Country: | Mauritius |

| Foundation year: | 2016 |

| Supported Platforms: | MT4 |

| Minimum Deposit: | $200 |

| Cryptocurrencies: | No |

| Types of Assets: | Forex, Commodities, Indices, Shares |

| Maximum Leverage: | 1:500 |

| Free Demo Account: | No |

| Accepts US clients: | Yes |

| Site Grid: | N/A |

Is Swiss Markets a Regulated Forex Broker?

As we mentioned FSA is the official institution that provides licensing for Forex and CFD trading companies. Even though they belong to the Tier 3 group of regulators, they still require companies to comply with some rules. Checking their database, we could see that the Swiss Markets broker holds its license indeed. More importantly, they are proud owners of the CySEC license.�

The main difference between Tier 1 and Tier 3 regulators are requirements for getting those. Tier 1 regulators like FCA, BaFin, and ASIC are the strictest ones. Unfortunately, Swiss Markets doesn’t have any of those most trusted licenses.

Why Is Trading On a Licensed Broker’s Platform Preferable?

To point out, the main benefit of licensing is security. For instance, to get a Tier 1 license clients need to have huge initial capital deposited. Moreover, they should have a separate bank account for clients’ funds. Lastly, they need to provide clients with compensation funds in case the company goes bankrupt.

What Platforms Do Swiss Markets Offer? – Available Trade Software

On the positive side, Swiss Markets broker provides a trusted trading platform. Meta Trader 4 is for years a leader in the Forex market primarily. Traders can get advanced indicators, charting options, high reliability and many more.�

That’s why it is now an industry-standard app. Important to mention is that this broker provided a detailed guide for the installation of Meta Trader on any device.����

Is The Platform Available On Mobile Devices? – Mobile Trading

To take an advantage of every market opportunity trader like to use mobile apps. Meta Trader 4 is a very reliable option for mobile trading and a very user-friendly option. Moreover, clients are not losing any functionality. No matter if you are using an Android or iOS device, you will have this option available.

What Traders Are Saying About Swiss Markets

Swiss Markets reviews are not something to brag about. Overall rating is 2.8 on Trustpilot. However, out of 25 reviews almost 90% of those are 1-star rated. Therefore, looks like the broker is not so trusted among traders. That’s why we need to develop our own opinion based on some facts.

Swiss Markets’s Trading Assets and Instruments

Points often overlooked are trading instruments. If the broker doesn’t provide enough opportunities for traders it is not attractive. Swiss Markets however provides a solid range of instruments. Those are divided into 4 groups:

- Forex � � � � USD/JPY, AUD/NZD

- Commodities oil, gold, platinum

- Indices� � � � � DAX30, CAC40

- Shares� � � � � Apple, Starbucks

Swiss Markets Broker’s Active Locations

Some brokers limit their services to specific countries. Sometimes it’s because of security reasons, but sometimes it’s up to business strategy. Whatever it is the reason for this broker we can see some pattern. They are targeting traders from:

- United States

- Switzerland

- India

- Italy

- Iraq

What Are The Different Swiss Markets Account Types?

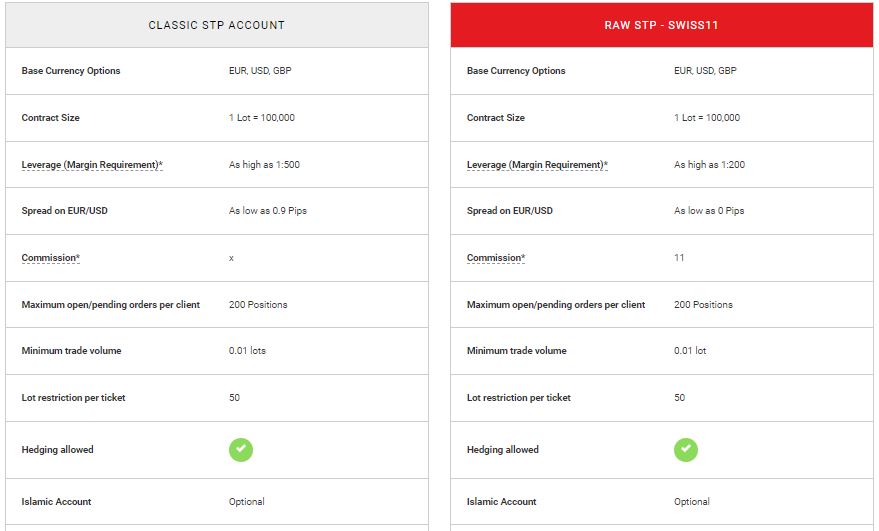

Many other licensed forex brokers offer multiple options to motivate traders to invest more. However, Swiss Markets offers only 2 account types. To point out, all accounts clients can open in 3 currencies – USD, GBP and EUR. Those accounts are:

- Classic STP account

- Raw STP Swiss 11

Both of the accounts allow hedging, which is great news for experienced traders. Besides commission, other trading conditions are fair and similar for both accounts.

Can a Trader Use a Demo Account?

Many other trading companies with MT4 offer a demo account. But Swiss Markets don’t do so. Considering their minimum requirement and loose licensing, it would be fair offer. Especially when we know that some Tier 1 licensed brokers offer a demo account or even a micro account. With these options, traders can see what to expect before committing to more money.

Minimum Deposit and How Do I Withdraw?

The minimum requirement for both accounts is $200. It is something that many traders can afford.� But with bad Swiss Markets reviews in mind, we should reconsider depositing here. On the other hand, withdrawals are processed within 24h. Moreover, they need to be processed through the same method as a deposit.

Looks like something shady, because no Tier 1 regulated broker has such requirements for its traders.

Payment Methods Available

Another key point is the option for funding the account. Swiss Markets broker accepts deposits with:

- Debit/Credit card

- Wire transfer

- E-wallet

Only wire transfers take a couple of days to be processed, but other methods are done instantly. On the contrary, based on any Swiss Markets review clients were complaining about withdrawals. Therefore, you can expect potential issues there. because you can only do it the same way as a deposit.

Terms and Conditions for Swiss Markets – What You Should Know

Important to realize is that the broker doesn’t offer guaranteed stop-loss. Not to mention that they don’t have negative balance protection. That protects clients from getting into debt. However, for many Tier 1 regulators, one of the obligations is to protect clients that way.

Leverage, Spreads, and Fees

With a competitive spread of 0.9 pips, they operate below average. But that is sometimes just a marketing trick. But leverage, which is violating ESMA rules for trading is a concerning fact. ESMA allows 1:30 for retail traders, while Swiss Markets offers 1:500. Apparently, the broker doesn’t charge any fees for deposits and withdrawals.

What Should I Do If I Have a Swiss Markets Problem?

Firstly, you should share your story with us. Secondly, try solving the problem with their regulator. Especially if those are withdrawal issues that other traders had. Thirdly, you can start the fund recovery process. Contact our fund recovery team to get a free consultation today!

What Is Swiss Markets?

It’s an offshore trading broker operating in Forex and CFD markets since 2016.

Is Swiss Markets a Regulated Broker?

Yes. Even though FSA is a Tier 3 group of regulators, it is a regulator in the end. Something bit better for is their CySEC license, but can’t compare with FCA or BaFin ones.

Is Swiss Markets Available in the United States or the UK?

As per Swiss Markets reviews, this broker offers services only to US clients.

Does Swiss Markets Offer a Demo Account?

No. Not only that they don’t offer a demo, not even a micro trading account.